Track every payment. Understand what's paid, what's slipping, and why.

Trellis applies every payment across your 3PL — delivering visibility into customer payment and insights to improve cash flow.

See the whole picture

Forecast incoming revenue. Identify slipping accounts.

Catch payment risks right away before they hit your cashflow.

Eliminate your manual cash application processes.

A single view across finance and ops

Smart Workflows. Real-time Visibility. Intelligent Insights.

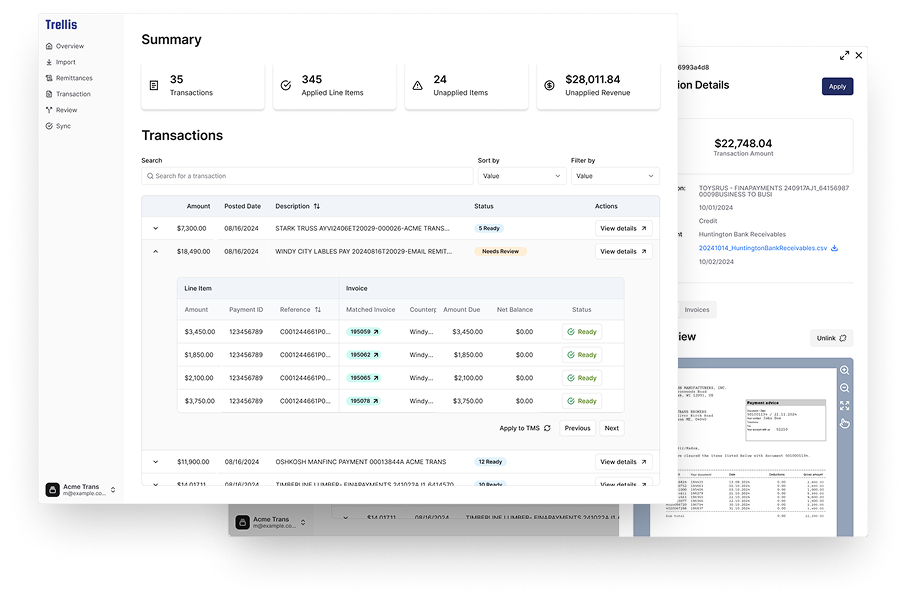

Eliminate manual cash application

No more printouts, spreadsheets, or sticky notes – apply payments in seconds, not hours.

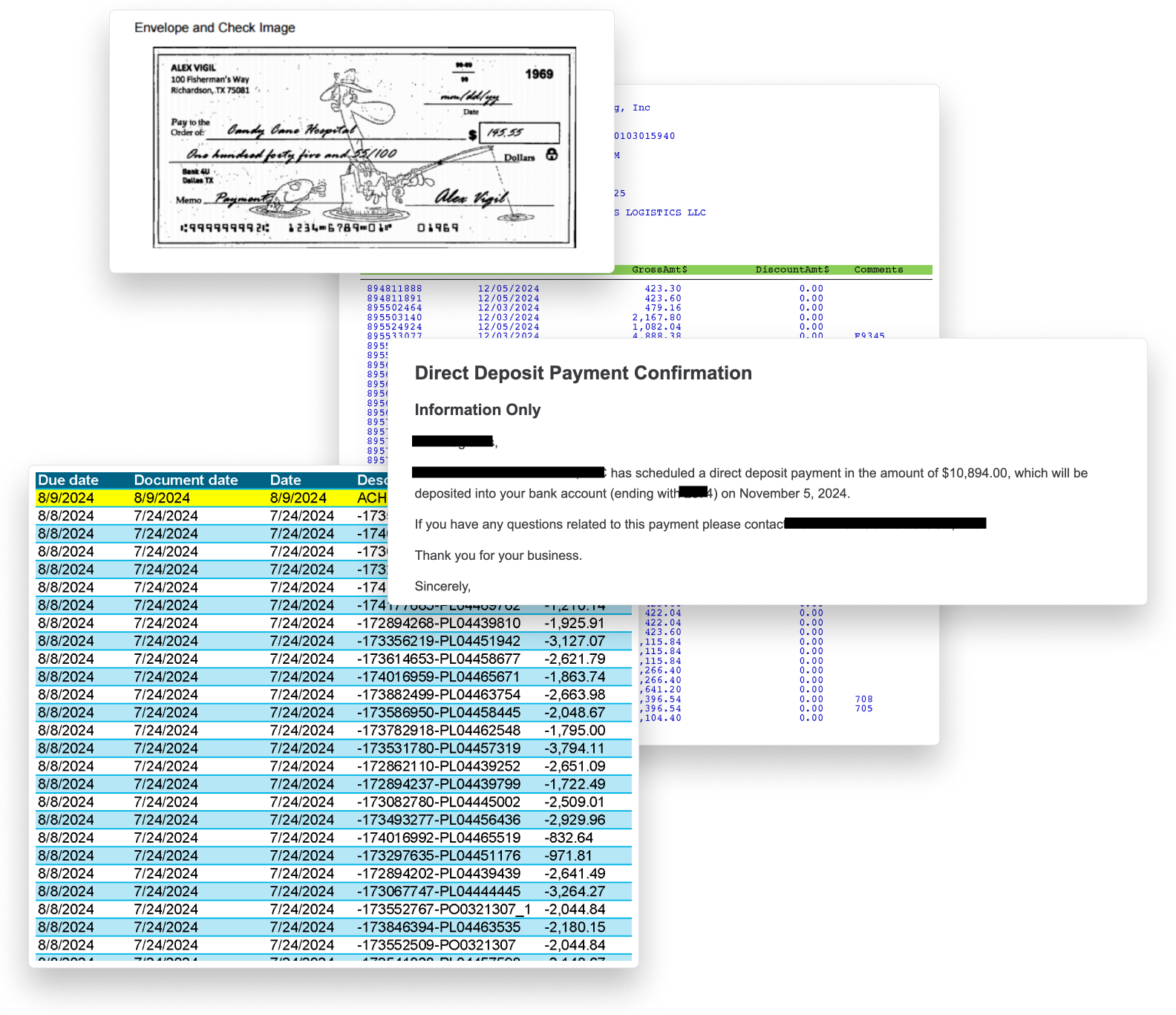

- Centralize payment data across banks and remittance formats for continuous cash application.

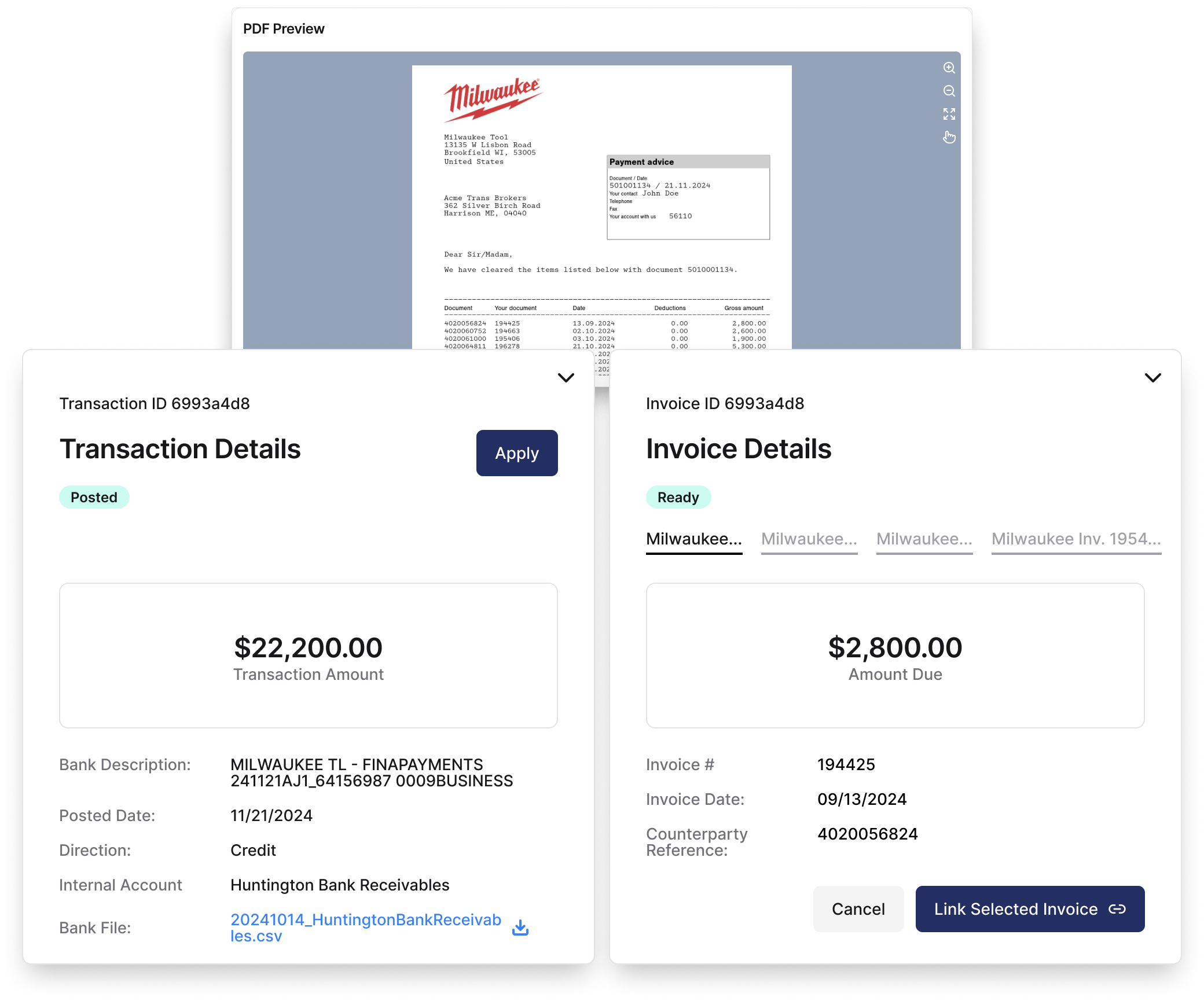

- Match every payment to the correct invoice or payable. Manage exceptions in a simple workflow.

- Post transactions back to your TMS and ERP to automatically update records.

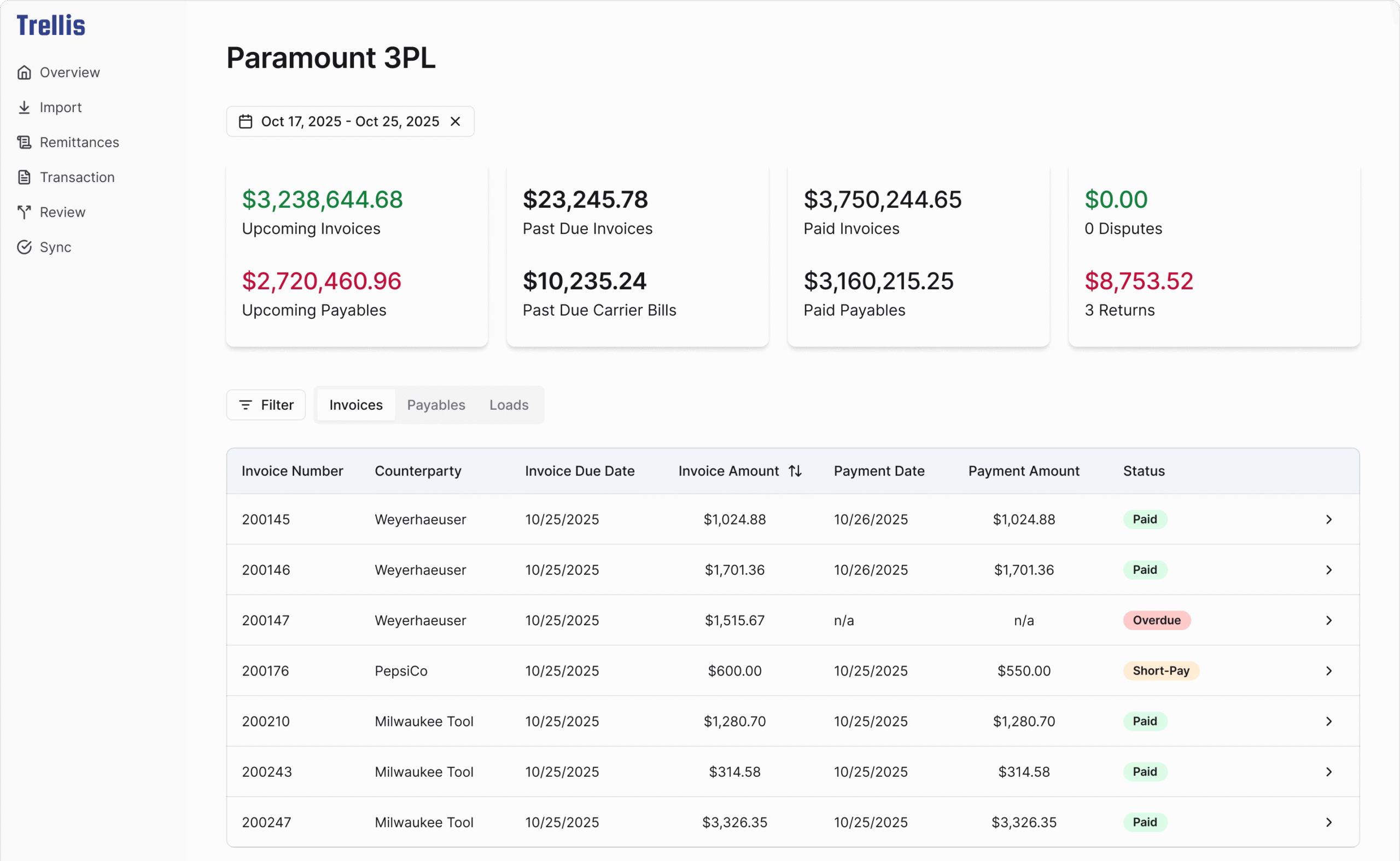

Stay ahead of every invoice, payable, and payment risk.

Real-time control over receivables and payables. Catch delays and short-pays before they affect cashflow.

- Recover lost revenue by catching payment variances at the invoice line-item level.

- Cut aging AR with real-time invoice visibility.

- Ensure accurate and on-time carrier payments.

Forecast cash, track revenue gaps, and prioritize efforts.

Predict cashflow and prioritize customer accounts.

- Predict the timing of expected revenue and highlight gaps right away.

- Identify accounts with declining revenue or shrinking spend.

Frequently asked questions

Cash application is the process of matching bank payments to open invoices and payables in your business systems.

Cash application gives answers to critical business questions:

- Have customers paid us for our services?

- Have we paid carriers for their services?

- Are we getting paid the right amount at the right time?

- Are we paying carriers the right amount at the right time?

Automated cash application improves productivity by eliminating the time spent manually matching a payment to an invoice or payable.

Additionally, automated cash application gives accounting teams real-time data to help run their back offices more efficiently. This includes identifying payment variances right away, following up on collections, responding to carrier payment status requests, and troubleshooting returned payments.

Trellis automates your 3PLs cash application by automatically applying bank payments to the correct operational item in your TMS, WMS, or accounting system.

Yes, Trellis works across your TMS(s), WMS(s), and ERPs systems.

Trellis sits on top of your TMS or WMS systems, allowing your 3PL to unify all open invoice and payable data across your numerous platforms.

Trellis centralizes financial data, applies cash against that data, and then syncs data automatically to the correct system of record.